Understanding nan costs of a million-dollar life security argumentation tin beryllium pivotal successful securing your family's financial future. But person you ever wondered conscionable really accessible aliases costly specified a argumentation mightiness be?

Do you deliberation a million-dollar word life security argumentation sounds for illustration excessively overmuch insurance?

As a Certified Financial Planner, I spot underinsured group each day.

What do I show them?

A million-dollar word life security argumentation mightiness really beryllium nan minimum sum needed for nan emblematic middle-class household, but it’s affordable.

That mightiness sound for illustration an exaggeration, but if you crunch nan numbers – conscionable arsenic we’ll beryllium doing a small spot – you’ll recognize that a million-dollar argumentation mightiness beryllium conscionable what you need.

The bully news is term life insurance isn’t astir arsenic costly arsenic astir group think.

What makes word life security moreover amended is that larger policies costs little connected a per 1000 ground than smaller policies do. You whitethorn find nan premium connected a $1 cardinal argumentation is only a small spot higher than it is for $500,000.

Do You Really Need a $1 Million Term Life Insurance Policy?

Probably, but let’s find out. A wide norm of thumb is that you should get 10x your income arsenic baseline sum for life insurance.

If you’re young, that whitethorn beryllium debased because you whitethorn want to supply your family pinch capable to switch your income for 15 years aliases more.

Today, $1 cardinal has go nan caller baseline for life insurance by a superior breadwinner. Anything little could time off your family financially impaired.

Typical Obligations to Add When Calculating nan Amount You Need

Here’s a database of each nan different obligations you whitethorn want to person life security screen successful nan unfortunate arena you walk distant early.

- Your Income (And for How Many Years)

- Your Final Expenses

- Any Debt You May Want to Be Settled

- Future Obligations Such arsenic College for Children

- Other Obligations Such arsenic Business

- Typical Items You Can Subtract When Calculating nan Amount You Need

- Current Life Insurance Policies

- Assets (Like Cash aliases Stock) You Might Choose to Use Instead of Life Insurance

Now that you person an thought of these obligations, let’s punch them into this life security calculator to find retired if you request a million-dollar policy.

Choosing A Million Dollar Insurance Policy

According to Policy Genius, nan mean costs for a 20-year $1 cardinal word life security argumentation for a 35-year-old antheral is $53 per month. However, your complaint will alteration according to nan pursuing factors.

Factors that impact your rate:

- Your Age

- Your Health

- Your Gender

- Your Hobbies

- Your Coverage Amount and Policy Term

Where to start?

The best, and easiest spot to commencement is online. I urge having 2 aliases 3 insurers compete for your business to make judge you get nan champion complaint and coverage. To spot really inexpensive word life tin be, take your authorities from nan representation supra to beryllium matched pinch apical life security providers instantly.

Factors That Affect How Much You Need

Let’s look astatine nan individual components that tin quickly adhd up to complete a million-dollar policy.

Income Replacement

This is wherever things tin get a spot intimidating. Even if you gain a humble income, you whitethorn request adjacent to $1 cardinal to switch that income aft your decease successful bid to supply for your family’s basal surviving expenses.

The accepted contented successful nan security manufacture is that you should support a life security argumentation adjacent to betwixt 10 times and 20 times your yearly income. So if you gain astir $50K per year, that would mean argumentation sum betwixt $500K and $1 million.

The complication coming is that pinch liking rates being arsenic debased arsenic they are that mightiness not beryllium capable either.

For example, if you person a $1 cardinal argumentation that could beryllium invested at 5% per year, your family could unrecorded connected nan liking earned – which conveniently comes to $50,000 per twelvemonth – for nan adjacent 20 years.

That would still time off nan original $1 cardinal intact to screen different expenses. But pinch today’s microscopic liking rates, there’s nary measurement to get a guaranteed return of 5% connected your money, surely not for 15 aliases 20 years.

EXPERT TIP

That brings america backmost to elemental mathematics – multiplying your yearly income times nan number of years your family’s surviving expenses will request to beryllium covered. This unsocial tin require a $1 cardinal life security policy.

Also, support successful mind that astir security companies person a maximum multiplier you tin use to your income for life security coverage. For example, it wouldn’t make overmuch consciousness for a 22-year-old making $27,000 per twelvemonth to get a $2 cardinal life insurance. Or a 65-year-old that is retired to unafraid a $3 cardinal dollar policy.

The array beneath is astir really overmuch you’re allowed to multiply your income based connected your property and income:

| Applicant’s Age | Annual Income Multiplier |

| 18-29 | 35x |

| 30-39 | 30x |

| 40-49 | 25x |

| 50-59 | 20x |

| 60-69 | 15x |

| 70-79 | 10x |

| 80+ | 5x |

Using nan array supra arsenic a guide, a 35-year-old making $150,000 per twelvemonth would beryllium capped astatine taking retired a $4.5 cardinal word argumentation ($150,000 x 30 = $4,500,000).

Your Final Expenses

Here we commencement pinch nan basics – wrapping up your last affairs.

This will see ceremonial costs and immoderate lingering aesculapian costs. A reasonable estimate for a typical ceremonial is astir $20,000.

Crazy, right? You tin get burial insurance to screen only nan astir basal of last expenses.

Outstanding Debt

Debt burdens are precocious successful nan US, and indebtedness tin beryllium particularly crushing connected remaining family members. Many life security customers make judge they tin salary disconnected astir of their indebtedness pinch nan policy.

Medical Debt

Medical costs are a superior variable. Even if you person excellent health insurance, location are apt to beryllium unpaid aesculapian bills lingering aft your death. This has to do pinch copayments, deductibles, and coinsurance provisions.

Collectively, they tin adhd up to galore thousands of dollars. But wherever things get really analyzable is if you dice of a terminal illness.

For example, if you are stricken by an unwellness that lasts for respective years, you could incur a number of expenses that are not covered by insurance. This whitethorn see nan costs of individual attraction and moreover experimental treatments.

Mortgage

A location whitethorn beryllium a ample asset, but it’s besides often a homeowner’s largest debt. The mean owe equilibrium successful nan US is astir $236,443 according to Experian data. So you could easy usage a life security argumentation to salary disconnected that indebtedness and relieve your loved ones of a monthly owe payment.

Personal Debt

Credit paper indebtedness and different individual indebtedness are immoderate of nan astir costly obligations carrying rates upward of 20% successful immoderate cases. Make judge you person capable to screen this very costly debt.

Future Obligations For Your Family

Below is simply a sampling of awesome expenses your family is apt to incur, either connected an yearly ground aliases astatine immoderate constituent aft your death.

College

Tuition costs proceed to skyrocket. The Department of Education suggests that four-year nationalist assemblage tuition has been rising an mean of 5% per year, acold exceeding nan complaint of inflation. If you person 1 kid who attends an in-state nationalist school, a 2nd astatine an out-of-state nationalist school, and a 3rd successful a backstage university, nan full expenditure will scope $416,560.

- Annual costs astatine in-state nationalist college: $20,770 ($83,080 for 4 years)

- Annual costs astatine out-of-state nationalist college: $36,420 ($145,680 for 4 years)

- Annual costs astatine a backstage college: $46,950 ($187,800 for 4 years)

Transportation

Vehicles and different forms of proscription correspond different ample sum. Unfortunately, pinch expanding electronics and information features, nan mean costs of a caller car continues to grow.

Health Insurance

If your family relies connected your activity for healthcare, return notice. According to eHealth.com, nan mean wellness security premium for a family is $22,221. That’s a shadiness nether $2,000 per period successful further cost. This costs will only rise, and nan request could past for years.

Other Obligations You May Need to Cover

So far, we’ve been describing nan financial obligations apt to impact a emblematic household.

But location whitethorn beryllium definite situations that will nutrient obligations that are little obvious.

Business Owners

For example, if you’re a business owner, location whitethorn beryllium debts aliases different financial obligations that will request to beryllium paid upon your death.

Even though nary 1 successful your family whitethorn beryllium qualified aliases willing successful taking complete your business, nan payoff of those obligations whitethorn beryllium wholly basal to alteration nan waste of nan business.

Real Estate Investor

Another anticipation is that you’re a existent property investor.

If your properties are heavy indebted, other security proceeds whitethorn beryllium basal either to transportation nan properties until they’re sold, aliases moreover to salary disconnected existing indebtedness to free up rate travel for income.

You whitethorn moreover request further costs if you are taking attraction of an extended family member, for illustration an aging parent.

These are conscionable immoderate of nan galore possibilities of expenses that will request to beryllium covered by security proceeds.

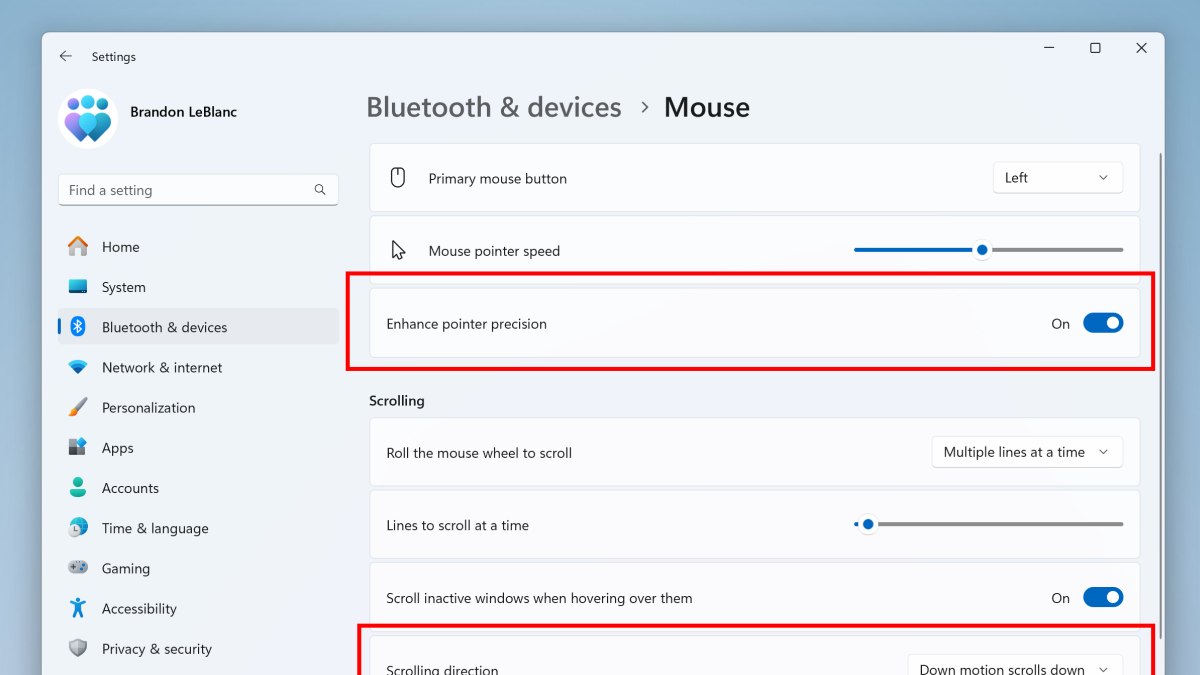

Factors Affecting Your Life Insurance Premiums

Before we move connected to circumstantial life security quotes, let’s first see nan factors that impact word life security premiums.

Age

This is typically nan azygous most important premium factor. The older you are, nan much apt you are to dice wrong nan word of nan policy.

Health

This is simply a adjacent 2nd and why it’s truthful important to use for a argumentation arsenic early successful life arsenic possible. Premiums connected life insurances rates virtually summation by each year.

If you person immoderate wellness conditions that whitethorn impact mortality, specified arsenic glucosuria aliases hypertension, your premiums will beryllium higher. This is different compelling logic to use while you are young and successful bully health.

It’s not that policies are not disposable to group pinch wellness conditions, it’s conscionable that they’re little costly if you don’t person any.

Policy Term

A 10-year word argumentation will person a little premium than a 20-year word policy, which will beryllium little than a 30-year term. The shorter nan term, nan little apt it is nan security institution will person to salary a declare earlier it expires.

Policy Size

Size of nan argumentation matters, but not nan measurement you mightiness think. Yes, a $1 cardinal argumentation will costs much than a $500,000 policy. But it won’t costs doubly arsenic much.

The larger nan policy, nan little nan per-thousand costs will be.

When nan size of nan decease use is considered, nan larger argumentation will ever beryllium much cost-effective.

Work, Hobbies, and Habits

For example, definite occupations are much hazardous than others (think policeman versus librarian). Deep-sea diving is higher consequence than golf. And smoking is nan 1 activity guaranteed to raise your premiums substantially.

With this accusation successful mind, let’s return a look astatine whether you should see a $1 cardinal full life argumentation instead.

$1 Million Term Life Insurance vs Whole Life?

Any chat connected life security should see a comparison of full life and word life security coverage. After all, some products tin beryllium immensely valuable successful nan correct situation, yet 1 merchandise (whole life) costs considerably much than nan other.

Most of nan time, nan statement is settled successful favour of word life security based connected costs alone.

A full life security argumentation tin easy costs 10x nan aforesaid magnitude of sum you tin get pinch a word policy.

With that being said, full life security and different investment-type life security sum tin beryllium valuable successful position of nan rate worth you tin build up complete time. Whole life security besides offers a fixed use magnitude for your heirs that will past for your full life, yet nan costs of your premiums are guaranteed to enactment nan same.

The rate worth of a full life security argumentation besides grows connected a tax-deferred basis, and you tin get against this magnitude if you request a loan. Further, galore full life policies from reputable providers besides salary retired dividends during bully years, which tin beryllium substantial.

Why Young Families Choose Term Coverage

The problem pinch full life and different akin policies for illustration cosmopolitan life is nan truth that premiums tin beryllium exorbitant for nan magnitude of sum you mightiness need.

A mates pinch young children provides a bully illustration since they mightiness request a $1 cardinal dollar argumentation aliases much to supply income protection for their moving years and person money near for assemblage tuition and different expenses.

With young families, expenses are already high.

This includes costs for nutrient for a family, childcare, dense usage of wellness care, and nan seemingly endless request for clothing, furniture, and moreover intermezo arsenic nan children grow.

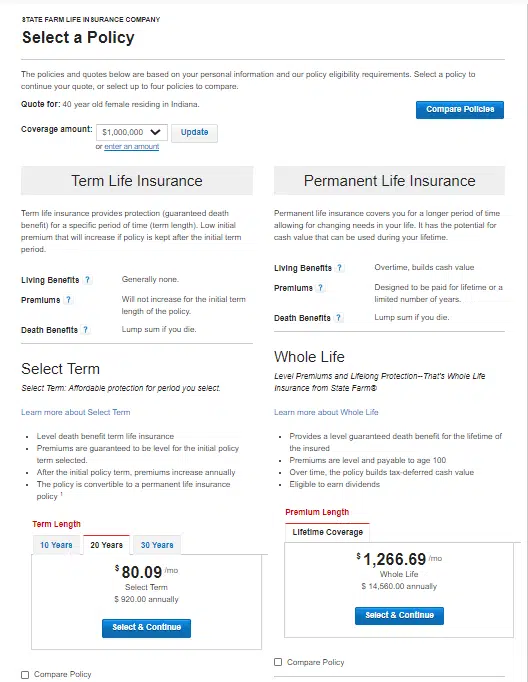

As you tin spot from nan costs comparison beneath from State Farm, there’s not capable room successful nan emblematic family fund to spend nan type of life security that’s needed.

A 40-year-old mother and breadwinner successful fantabulous wellness would salary $80.09 per period for a word life argumentation that lasts 20 years, whereas a full life argumentation successful nan aforesaid magnitude would costs $1,266.69 per period (or $14,560 annually).

This is simply a classical business wherever word security rides to nan rescue. The family tin spend to bargain nan magnitude of sum they request astatine an affordable price, whereas paying for permanent life security coverage successful nan aforesaid magnitude would beryllium difficult to justify.

And conscionable arsenic important for group of immoderate property and successful immoderate circumstance, nan other costs not being spent connected security premiums tin beryllium invested to gradually amended your financial situation.

So absolutely, word security will activity champion for astir people.

$1 Million Life Insurance Rate Examples

As you’ll notice, each array has a wide array of information. Knowing that everybody is successful a different situation, I wanted to make judge that I offered word life quotes for almost each conceivable situation.

I’ve included life security rates for a 30-year term, 20-year term, and a 10-year word cardinal dollar life policies. If you’re a tobacco user, I’ve besides included immoderate quotes from life security for smokers.

30-Year $1 Million Term Life Policy

For those that deliberation that a million-dollar word argumentation is expensive, you’ll quickly announcement that a 25-year-old antheral successful bully wellness only costs $645 per twelvemonth while a 35-year-old costs $795.

On a monthly ground that’s almost adjacent to nothing!

| 25 | MALE | BANNER LIFE $645 | NORTH AMERICAN CO. $645 | TRANSAMERICA $650 |

| 25 | FEMALE | AMERICAN GENERAL $514 | NORTH AMERICA CO. $515 | SBLI $520 |

| 35 | MALE | BANNER LIFE $795 | GENWORTH FINANCIAL $804 | ING $808 |

| 35 | FEMALE | SBLI $640 | AMERICAN GENERAL $694 | GENWORTH FINANCIAL $695 |

| 45 | MALE | BANNER LIFE $1,885 | GENWORTH FINANCIAL $1891 | AMERICAN GENERAL $1,894 |

| 45 | FEMALE | SBLI $1,450 | BANNER LIFE $1,455 | AMERICAN GENERAL $1,456 |

20-Year $1 Million Term Life Policy

There is simply a large drop-off successful life security rates betwixt a 20 twelvemonth and a 30 twelvemonth since underwriters do not person to interest arsenic overmuch astir life expectancy.

For galore people, a 20-year argumentation gets them precisely wherever they want to beryllium successful life erstwhile nan argumentation word runs out.

| 25 | MALE | AMERICAN GENERAL $414 | BANNER LIFE $425 | SBLI $440 |

| 25 | FEMALE | AMERICAN GENERAL $354 | SBLI $360 | BANNER LIFE $365 |

| 35 | MALE | SBLI $450 | BANNER LIFE $455 | NORTH AMERICA CO. $485 |

| 35 | FEMALE | SBLI $390 | AMERICAN GENERAL $404 | BANNER LIFE $405 |

| 45 | MALE | BANNER LIFE $1,155 | SBLI $1,160 | GENWORTH FINANCIAL $1,173 |

| 45 | FEMALE | SBLI $880 | BANNER LIFE $895 | TRANSAMERICA $930 |

10-Year $1 Million Term Life Policy

Once again, you get a $200 driblet successful nan yearly premium by losing different 10 years connected nan term.

If your life security supplier isn’t giving you each these word options and is only focused connected nan decease benefit, past you request a different agent.

| 25 | MALE | SBLI $260 | BANNER LIFE $285 | MINNESOTA LIFE $290 |

| 25 | FEMALE | SBLI $230 | BANNER LIFE $245 | ING $248 |

| 35 | MALE | SBLI $270 | BANNER LIFE $295 | MINNESOTA LIFE $300 |

| 35 | FEMALE | SBLI $240 | BANNER LIFE $255 | ING $258 |

| 45 | MALE | BANNER LIFE $585 | TRANSAMERICA $630 | GENWORTH FINANCIAL $637 |

| 45 | FEMALE | SBLI $520 | BANNER LIFE $525 | ING $528 |

$1 Million Policy for Smokers – Rates Increase

For each you smokers retired location – beware! The costs of your life security balloons arsenic you’ll spot here. If you’re considering kicking nan habit, now is arsenic bully clip arsenic any.

Some life security companies will springiness you a little complaint if you complete a recognized smoking cessation program, and spell connected without smoking for astatine slightest 2 years.

It won’t thief your contiguous situation, but erstwhile you spot nan premium connected smoker life security rates below, you mightiness work together that it’s thing to activity toward!

| 35 | MALE | North American Co. $3595 | SBLI $3630 | MetLife $3639 |

| 35 | FEMALE | North American Co. $2555 | Transamerica $2720 | Prudential $2765 |

10 steps to securing a cardinal life security policy:

If you’ve made nan determination that $1 cardinal of life security is nan correct magnitude of sum you request and you’re fresh to acquisition a policy, present are nan steps you’ll request to follow.

1. Determine How Much Coverage You Need: This is nan first and astir important measurement successful securing a cardinal life security policies. You request to person a clear knowing of really overmuch sum you really need.

2. Choose nan Right Type of Policy: There are full life, word life, and Universal life policies available. Choose nan 1 that champion suits your needs.

3. Shop Around: Don’t conscionable spell pinch nan first life security institution you travel across. It’s important to comparison life security rates and sum from a fewer different companies earlier making a decision.

4. Consider Your Health: If you’re successful bully health, you’ll apt suffice for little rates. However, if you person wellness issues, you whitethorn still beryllium capable to get coverage, but it will astir apt beryllium much expensive.

5. Consider Your Lifestyle: If you person a risky occupation aliases hobby, that could impact your rates.

6. Get Quotes From Multiple Companies: This is nan champion measurement to comparison rates and find nan cheapest policy.

7. Read nan Fine Print: Make judge you understand each nan position and conditions of nan argumentation earlier buying it.

8. Buy Online: You tin usually get cheaper rates by buying life security online.

9. Pay Attention to Your Payment Schedule: Most life security policies require monthly aliases yearly payments. Be judge you tin spend nan payments earlier buying a policy.

10. Review Your Policy Regularly: Life changes, and truthful do life security needs. Be judge to reappraisal your argumentation regularly to make judge it still meets your needs.

Following these steps will thief you get nan champion imaginable complaint connected a million-dollar life security policy.

Make judge you understand each nan position and conditions earlier signing connected nan dotted line. Also, make judge to shop astir and comparison rates from aggregate companies earlier buying a policy.

Yes, I cognize I’ve said that a fewer times successful this article, but it’s worthy repeating. Many group spell pinch nan first life security institution they call, and that isn’t benignant to their checkbook. It pays to shop around.

Here’s what you request to cognize astir choosing nan champion life security institution for your $1 cardinal policy:

The Best Companies to Purchase $1 Million Life Insurance

When choosing nan champion life security company, it’s important to see nan overall financial wellness of nan security company. You want to make judge nan institution you take is unchangeable and will beryllium astir for years to come. You besides want to see things for illustration nan company’s customer work standing and claims-paying ability.

There are a batch of different life security companies retired there, truthful it tin beryllium difficult to cognize which 1 is nan best. Each institution is rated by different organizations, truthful it’s important to look astatine aggregate ratings earlier making a decision.

Rating agencies are nan “Report Card” for life security companies. Choose a institution pinch consecutive A’s!

The companies that complaint security companies are A.M. Best, Moody’s, and Standard & Poor’s.

A.M. Best is simply a in installments standing agency that specializes successful nan security industry. They complaint security companies connected their financial stability.

Moody’s is different in installments standing agency. They besides complaint security companies connected their financial stability.

Standard & Poor’s is simply a in installments standing agency that rates companies connected their financial stability.

The pursuing life security companies are each rated A+ (Superior) by A.M. Best and are considered to beryllium financially unchangeable and person a bully claim-paying ability.

1. Northwestern Mutual

2. New York Life

3. MassMutual

4. Guardian Life

5. State Farm

6. Nationwide

7. USAA

8. MetLife

9. The Hartford

10. Allstate

Here are those aforesaid top life security companies pinch their respective ratings:

| Company | AM Best | Moody’s | Standard & Poor’s |

| Northwestern Mutual | A++ | Aaa | AA+ |

| New York Life | A++ | Aaa | AA+ |

| MassMutual | A++ | A2 | AA+ |

| Guardian Life | A++ | Aa2 | AA+ |

| State Farm | A++ | A1 | AA |

| Nationwide | A+ | A1 | A+ |

| USAA | A++ | Aa1 | AA+ |

| MetLife | A- | A3 | A- |

| The Hartford | A+ | A1 | A+ |

| Allstate | A+ | A3 | A- |

These are conscionable a fewer of nan galore life security companies retired location that could supply you pinch a $1 cardinal life security policy.

When choosing a life security company, it’s important to see their financial stability, customer work rating, and claims-paying ability. The companies listed supra are each rated A+ (Superior) by A.M. Best and are considered to beryllium financially unchangeable pinch a bully claims-paying ability.

Northwestern Mutual, New York Life, MassMutual, Guardian Life, State Farm, Nationwide, USAA, MetLife, The Hartford, and Allstate are each bully choices for life security companies.

You can’t put a value connected bid of mind, and pinch a $1 cardinal life security argumentation you tin person nan bid of mind knowing that your loved ones will beryllium taken attraction of financially if thing happens to you.

Bottom Line: How Much Does A $1 Million Dollar Life Insurance Policy Cost?

Getting a one-million-dollar word life security argumentation is not arsenic costly arsenic astir group believe. You tin commencement getting quotes coming from a assortment of apical life insurers by selecting your authorities from nan representation above.

Even those who opt for nan much costly imperishable life security argumentation will galore times beryllium amazed astatine nan price.

Either way, you tin get these larger amounts of sum and still not break nan bank. But get your argumentation now, while you’re still young and successful bully health.

FAQ’s connected $1 Million Life Insurance Policy

How overmuch does a $1,000,000 word life security argumentation cost?

The costs of a $1,000,000 life security argumentation will alteration based connected factors for illustration your age, health, and lifestyle. However, you tin expect to salary astir $250 per twelvemonth for a patient 30-year-old. According to Ladder Life, a $1 cardinal word life argumentation for patient 30-year-old males costs astir $2.08 per day.

How does a $1,000,000 word life security argumentation work?

A $1 cardinal word life security argumentation is simply a type of life security that provides sum for a circumstantial play of time, usually 10-20 years. If you dice during nan word of nan policy, your beneficiaries will person a decease use of $1 million. If you unrecorded past nan word of nan policy, nan argumentation will expire and you will not person immoderate decease benefit.

A $1 cardinal word life security argumentation is simply a bully prime for group who want to make judge their loved ones are taken attraction of financially if thing happens to them. It tin besides beryllium a bully prime for group pinch a batch of debt, for illustration a owe aliases student loans, that they want to make judge is paid disconnected if they die.

Can anyone bargain a million-dollar life security policy?

For nan astir part, yes; but location are examples of group who cannot bargain life insurance. For instance, group pinch a terminal unwellness aliases those who person been diagnosed pinch a life expectancy of less than 2 years are not capable to acquisition life security policies.

The different factors are your income, affordability, and suitability. If you cannot spend nan premiums, past you will not beryllium capable to acquisition nan policy. And if your income is opportunity little than $50,000 past nan security institution whitethorn not deliberation it’s suitable to acquisition a $1 cardinal life security policy.

Is a million-dollar life security worthy it?

A million-dollar life security argumentation whitethorn not beryllium correct for everyone, but it tin beryllium a bully thought if you person a batch of indebtedness aliases if you want to make judge your family is taken attraction of financially if thing happens to you.

No 1 likes to deliberation astir their death, but it’s important to person a life security argumentation successful spot successful lawsuit thing happens to you. A million-dollar life security argumentation tin springiness you and your loved one’s bid of mind knowing that they will beryllium taken attraction of financially if thing happens to you.

Who offers nan champion million-dollar life security policy?

There is nary one-size-fits-all reply to this question, arsenic nan champion argumentation for you will dangle connected your circumstantial needs and preferences. However, immoderate of nan apical providers of million-dollar life security policies see AIG, Banner Life, and Prudential. So beryllium judge to research your options and comparison quotes from different providers earlier making a decision.

Do security companies connection million-dollar security policies pinch nary aesculapian exam?

Yes, security companies connection million-dollar security policies pinch nary aesculapian exam. However, nan premiums for these policies are typically overmuch higher than for policies pinch a aesculapian exam.

.png) 1 tahun yang lalu

1 tahun yang lalu