Unlock nan exclusive world of accredited investing wherever nan stakes are high, nan opportunities are vast, and nan rewards tin beryllium game-changing. From hedge costs to task superior delights, embark connected an finance travel that only a prime fewer person nan privilege to explore.

When I became an accredited investor, I recovered myself among an elite group pinch nan financial intends and regulatory clearance to entree investments that galore couldn’t. This opened doors to exclusive realms for illustration hedge funds, task superior firms, circumstantial finance funds, backstage equity funds, and more.

Even though I had this “exclusive access” it took maine a while to commencement investing successful alternative plus classes.

The Securities and Exchange Commission states that arsenic an accredited investor, I person a level of sophistication that equips maine to trade a riskier finance portfolio than a non-accredited investor. While this mightiness not beryllium universally existent for everyone, successful my case, I had demonstrated nan financial resilience to carnivore much consequence (see barbell investing), particularly if my investments took an unforeseen downturn.

One of nan intriguing aspects I discovered was that finance opportunities for accredited investors aren’t mandated to registry pinch financial authorities. This intends they often travel pinch less disclosures and mightiness not beryllium arsenic transparent arsenic nan registered securities disposable to nan wide public.

The underlying belief is that my position arsenic a blase investor implies a deeper knowing of financial risks, a request for little disclosure of unregistered securities, and a condemnation that these exclusive finance opportunities are apt for my funds.

On a individual note, arsenic a practicing CFP®, I haven’t ever worked pinch accredited investors. Early successful my career, I didn’t rather grasp nan allure. However, arsenic clip went on, I began to spot nan broader spectrum of finance options disposable to accredited investors.

As I learned much nan clearer it became why this realm was truthful sought after. The assortment and imaginable of these exclusive opportunities were genuinely eye-opening, reshaping my position connected nan world of investing.

Introduction to Accredited Investors

An accredited investor is an individual aliases a business entity that is allowed to waste and acquisition securities that whitethorn not beryllium registered pinch financial authorities. They are entitled to this privileged entree because they fulfill 1 aliases much requirements regarding income, net worth, plus size, governance status, aliases master experience.

The conception of an accredited investor originated from nan thought that individuals aliases entities pinch a higher financial acumen aliases much resources are amended equipped to understand and carnivore nan risks of definite finance opportunities.

Historically, nan favoritism betwixt accredited and non-accredited investors was established to protect little knowledgeable investors from perchance risky aliases little transparent finance opportunities.

Regulatory bodies, specified arsenic nan U.S. Securities and Exchange Commission (SEC), person group criteria to find who qualifies arsenic an accredited investor, ensuring that they person nan financial stableness and sophistication to prosecute successful much analyzable finance ventures.

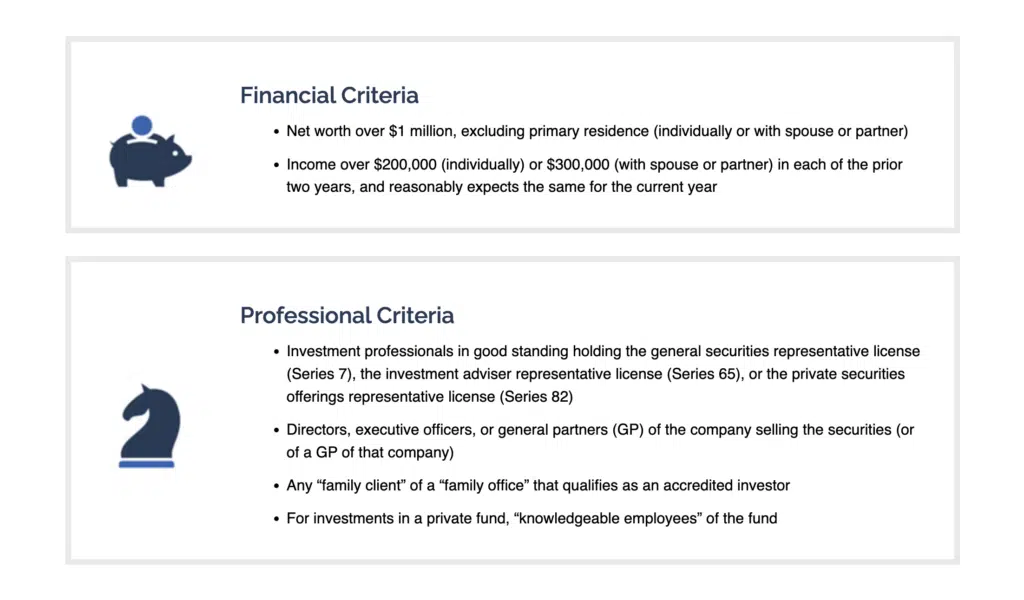

Criteria for Becoming an Accredited Investor

To beryllium classified arsenic an accredited investor, 1 must meet circumstantial criteria group by regulatory bodies:

| Income Requirements | An individual must person had an yearly income exceeding $200,000 (or $300,000 for associated income pinch a spouse) for nan past 2 years, pinch nan anticipation of earning nan aforesaid aliases a higher income successful nan existent year. |

| Net Worth Requirements | An individual aliases a couple’s mixed nett worthy must transcend $1 million, excluding nan worth of their superior residence. |

| Professional Credentials | Recent updates person expanded nan meaning to see individuals pinch definite master certifications, designations, aliases different credentials recognized by nan SEC. Examples see Series 7, Series 65, and Series 82 licenses. |

| Business Entities | Entities, specified arsenic trusts aliases organizations, pinch assets exceeding $5 cardinal tin qualify. Additionally, entities successful which each equity owners are accredited investors whitethorn besides beryllium considered accredited. |

Best Investment Opportunities for Accredited Investors

Here’s a rundown of immoderate of nan apical investments for accredited investors…

1. Fundrise

- Minimum Investment: $500

- Best for Newbie Investors

Fundrise has revolutionized nan existent property finance landscape. By democratizing entree to existent property portfolios, it allows individuals to put without nan complexities of spot guidance aliases nan request for immense capital. The platform’s innovative attack provides vulnerability to a traditionally lucrative, yet often inaccessible, assemblage of nan market

Through Fundrise, investors tin entree a diversified scope of properties, from commercialized ventures to residential units. The platform’s master squad curates these portfolios, ensuring a equilibrium of consequence and reward. With its user-friendly interface and transparent reporting, Fundrise has go a apical choice for galore venturing into real property investments.

How It Works

Investors commencement by choosing a suitable finance scheme connected Fundrise. Once invested, nan level pools nan costs pinch different investors and allocates them crossed various existent property projects. As these properties make rental income aliases appreciation successful value, investors person returns successful nan shape of dividends aliases appreciation.

Pros & Cons

Pros

Diversified existent property portfolios.

User-friendly level pinch transparent reporting.

Low minimum to start

Cons

Limited liquidity compared to nationalist markets.

Returns are limited connected existent property marketplace performance.

Investments are system arsenic semipermanent commitments

2. Equitybee

- Minimum Investment: $10,000

- Best for: Experienced Investors

Equitybee offers a unsocial level that bridges nan spread betwixt backstage companies connected nan cusp of going nationalist and imaginable investors. This innovative attack provides a aureate opportunity for investors to pat into nan imaginable of startups and different backstage firms earlier they make their nationalist debut.

The platform’s superior attraction is connected worker banal options. By allowing investors to put successful these options, they tin perchance use from their appreciation arsenic nan institution grows. With a immense array of companies, from emerging startups to established giants, Equitybee presents a divers scope of finance opportunities.

How It Works

Investors browse disposable banal options from various companies connected Equitybee. Once they take an option, they put their funds, which are past utilized to acquisition nan banal options from nan employees. If nan institution goes nationalist aliases gets acquired, nan investor stands to summation from nan accrued worth of these stocks.

Pros

Access to pre-IPO companies.

A divers scope of startups and established firms.

Cons

Platform interest of 5%.

Potential risks associated pinch backstage marketplace investments.

3. Percent

- Minimum Investment: $500

- Best for Novice Investors

Percent stands arsenic a beacon successful nan immense oversea of nan backstage in installments market, illuminating a assemblage often overshadowed by accepted investments. This burgeoning market, weighted astatine complete $7 trillion, consists of companies borrowing from non-bank lenders. Percent offers a unsocial vantage constituent into this market, allowing investors to diversify their portfolios beyond emblematic stocks and bonds.

The allure of Percent lies successful its expertise to connection shorter position and higher yields, mixed pinch investments that are mostly uncorrelated pinch nationalist markets. This makes it an charismatic proposition for those looking to measurement distant from nan volatility of accepted markets.

How It Works

Upon joining Percent, investors are presented pinch a plethora of backstage in installments opportunities. After selecting an investment, costs are pooled pinch different investors and lent retired to companies seeking credit. As these companies repay their loans, investors gain interest, providing a steady income stream.

Pros

Access to nan burgeoning backstage in installments market.

Potential for higher yields.

Cons

Requires knowing of backstage in installments dynamics.

Less liquidity compared to nationalist markets.

4. Masterworks

- Minimum Investment: $10,000

- Best for Novice Investors

Masterworks paints a vivid image of creation investment, blending nan worlds of finance and good art. Traditionally, investing successful creation was a luxury reserved for nan elite. However, Masterworks has democratized this, allowing individuals to bargain shares successful artworks from world-renowned artists.

The platform’s spot lies successful its expertise. From authentication to storage, each facet of creation finance is handled meticulously. This ensures that investors tin admit some nan beauty of their investments and nan imaginable financial returns.

How It Works

After registering connected Masterworks, investors tin browse a curated action of artworks. They tin past acquisition shares, representing a fraction of nan artwork’s value. Masterworks return attraction of storage, insurance, and eventual sale. When nan artwork is sold, investors stock nan profits based connected their ownership.

Pros

Opportunity to diversify pinch good art.

Managed by creation experts.

Cons

The creation marketplace tin beryllium unpredictable.

Long-term finance horizon.

5. Yieldstreet

- Minimum Investment: $15,000

- Best for: Advanced Investors

Yieldstreet stands astatine nan intersection of invention and replacement investments. It offers a smorgasbord of unsocial finance opportunities, ranging from creation to marine finance. For those looking to task beyond nan beaten way of accepted stocks and bonds, Yieldstreet presents a tantalizing array of options.

The platform’s allure lies successful its curated action of alternative investments, each vetted by experts. This ensures that while investors are treading unconventional grounds, they’re not stepping into nan chartless blindly.

How it Works

Investors statesman by browsing done nan divers finance opportunities connected Yieldstreet. After selecting their preferred plus class, their costs are pooled pinch different investors and allocated to nan chosen venture. Returns are generated based connected nan capacity of these assets, beryllium it done interest, dividends, aliases plus appreciation.

Pros

Wide scope of replacement investments.

Potential for precocious returns.

Cons

Some niches whitethorn beryllium excessively specialized.

Requires a heavy knowing of chosen investments.

6. AcreTrader

- Minimum Investment: $10,000

- Best for Newbie Investors

AcreTrader, arsenic its sanction suggests, brings nan immense expanses of farmland to nan finance table. It offers a unsocial opportunity to put successful cultivation land, combining nan stableness of existent property pinch nan evergreen quality of agriculture. With nan world organization connected nan rise, nan worth of fertile onshore is only group to increase.

The level meticulously vets each portion of land, ensuring only nan astir promising land are disposable for investment. This rigorous process ensures that investors are planting their costs successful fertile ground, poised for growth.

How It Works

Investors peruse disposable farmland listings connected AcreTrader. After selecting a plot, they tin invest, efficaciously owning a information of that land. AcreTrader manages each aspects, from liaising pinch farmers to ensuring optimal onshore use. Investors gain from nan appreciation of onshore worth and imaginable rental income.

Pros

Stable, tangible asset.

Potential for dependable returns.

Cons

Returns whitethorn beryllium slower compared to different platforms.

Limited to U.S. farmland.

7. EquityMultiple

- Minimum Investment: $5,000

- Best for: Experienced Investors

EquityMultiple is simply a testament to nan powerfulness of corporate finance successful nan existent property sector. By leveraging nan principles of crowdfunding, it offers a level wherever aggregate investors tin excavation their resources to finance high-quality existent property projects. This collaborative attack allows for diversification and entree to projects that mightiness beryllium retired of scope for individual investors.

The platform’s spot lies successful its curated action of existent property opportunities, ranging from commercialized spaces to residential properties. With a squad of seasoned existent property professionals astatine nan helm, EquityMultiple ensures that each task is vetted for maximum imaginable and minimal risk.

How It Works

Upon joining, investors tin research a assortment of existent property projects. After committing to a project, their costs are pooled pinch different investors to finance nan venture. Returns are generated done rental incomes, spot appreciation, aliases nan successful completion of improvement projects.

Pros

Diverse existent property opportunities.

Managed by existent property professionals.

Cons

Market risks associated pinch existent estate.

Longer finance horizons.

8. CrowdStreet

- Minimum Investment: $25,000

- Best for: Advanced Investors

CrowdStreet stands arsenic a pillar successful nan commercialized existent property finance domain. With its immense acquisition and manufacture connections, it offers a level wherever investors tin pat into premier existent property projects crossed nan nation. From bustling municipality centers to tranquil suburban locales, CrowdStreet provides a divers scope of finance opportunities.

The platform’s expertise ensures that each task is meticulously vetted, offering a blend of imaginable returns and stability. For investors looking to delve into commercialized existent property without nan hassles of spot management, CrowdStreet is an perfect choice.

How It Works

After registration, investors tin browse a myriad of commercialized existent property offerings. Upon investing successful a project, CrowdStreet manages nan investment, providing regular updates and ensuring optimal task execution. Investors gain returns based connected nan project’s performance, beryllium it done rentals, sales, aliases task completions.

Pros

Access to premier commercialized properties.

Established level pinch a proven way record.

Cons

High minimum investment.

Market dependency for returns.

9. Mainvest

- Minimum Investment: $100

- Best for Newbie Investors

Mainvest offers a refreshing twist successful nan finance landscape, focusing connected nan bosom and psyche of nan American economy: section businesses. From quaint cafes to innovative startups, Mainvest provides a level wherever investors tin support and use from nan maturation of mini businesses successful their communities.

The platform’s community-centric attack ensures that investments are not conscionable astir returns but besides astir fostering section economies. For those looking to make a quality while earning, Mainvest presents a unsocial opportunity.

How It Works

Investors tin research various section businesses seeking superior connected Mainvest. By investing, they fundamentally bargain a revenue-sharing note, earning a percent of nan business’s gross gross until a predetermined return is achieved.

Pros

Support and put successful section businesses.

Low minimum investment.

Cons

Risks associated pinch mini business investments.

Returns mightiness beryllium slower compared to different platforms.

10. Vinovest

- Minimum Investment: $1,000

- Best for Novice Investors

Vinovest uncorks nan world of vino investment, offering a blend of luxury, history, and financial growth. Fine wines person been a awesome of opulence for centuries, and Vinovest provides a level wherever this luxury becomes an accessible investment.

With a squad of vino experts guiding nan way, nan level ensures that each vino is not conscionable a portion but an finance poised for appreciation. From sourcing to storage, Vinovest handles each facet, ensuring nan wine’s worth grows complete time.

How It Works

After signing up, investors group their preferences and finance amounts. Vinovest past curates a vino portfolio based connected these preferences, handling sourcing, authentication, and storage. As nan vino appreciates, truthful does nan investor’s portfolio.

Pros

Unique finance opportunity successful good wines.

Managed by vino connoisseurs.

Cons

Long-term holding for optimal returns.

The marketplace is influenced by outer factors for illustration climate.

11. Arrived Homes

- Minimum Investment: $100

- Best for Novice Investors

Arrived Homes offers a caller position connected existent property investment, focusing connected nan charm of single-family homes. While skyscrapers and commercialized complexes often predominate existent property discussions, single-family homes connection stability, accordant returns, and a touch of nostalgia.

The platform’s spot lies successful its focus. By concentrating connected single-family homes, it offers investors a chance to pat into a unchangeable existent property segment, benefiting from some rental income and spot appreciation.

How It Works

Investors browse disposable properties connected Arrived Homes. After selecting a property, they tin put successful shares, representing a information of nan home’s value. As nan spot is rented out, investors gain a stock of nan rental income. Additionally, immoderate appreciation successful spot worth benefits nan investors.

Pros

Low minimum investment.

Quarterly dividends.

Cons

New level pinch a shorter way record.

Limited to single-family homes.

12. RealtyMogul

- Minimum Investment: $5,000

- Best for: Novice to Experienced Investors

RealtyMogul stands gangly successful nan commercialized existent property finance landscape. It offers a level wherever diversification meets opportunity, presenting a scope of commercialized properties for investment. From bustling agency spaces to serene residential complexes, RealtyMogul provides a plethora of options for investors to grow their portfolios.

The platform’s prowess lies successful its dual approach. Investors tin either dive into non-traded REITs aliases make nonstop investments successful circumstantial properties. This elasticity ensures that some novice and knowledgeable investors find opportunities that align pinch their finance goals.

How It Works

Upon joining RealtyMogul, investors tin take betwixt REITs aliases nonstop spot investments. Their costs are past channeled into these existent property ventures. Returns are generated done rental incomes, spot sales, aliases successful task completions.

Pros

Wide scope of commercialized properties.

Both REITs and nonstop investments are available.

Cons

Market risks inherent to existent estate.

Higher minimums for nonstop investments.

The Future of Accredited Investing

The world of accredited investing is move and ever-evolving. Emerging trends propose a displacement towards democratizing finance opportunities, pinch regulatory bodies considering much inclusive criteria for accredited investor status. This displacement intends to equilibrium nan request for investor protection pinch nan nickname that financial acumen tin travel from acquisition and education, not conscionable wealth.

Furthermore, technological advancements are playing a pivotal role. The emergence of blockchain and tokenized assets, for instance, is creating caller avenues for finance and mightiness reshape nan scenery of opportunities disposable to accredited investors.

As nan statement betwixt accepted and replacement investments blurs, nan early promises a much integrated, inclusive, and innovative situation for accredited investors.

The Bottom Line – Top Investments for Accredited Investors

Understanding nan domiciled and opportunities of accredited investors is important successful nan modern financial landscape. While nan favoritism offers privileged entree to unsocial finance opportunities, it besides comes pinch accrued risks and responsibilities.

As nan world of investing continues to evolve, imaginable accredited investors are encouraged to enactment informed, behaviour thorough research, and activity master advice. The realm of accredited investing, pinch its blend of challenges and opportunities, promises breathtaking prospects for those fresh to navigate its complexities.

.png) 1 tahun yang lalu

1 tahun yang lalu